Arbitrage trading is a smart strategy that involves profiting from price differences in the same or similar financial instruments across various markets or exchanges. The basic idea is to buy an asset at a lower price in one market and sell it simultaneously in another at a higher price, making money from the price gap.

Arbitrage opportunities happen when an asset’s price deviates from its equilibrium level, creating temporary disparities that traders can exploit. They aim to make a profit by identifying and taking advantage of these differences through methods like statistical arbitrage, pairs trading, and triangular arbitrage.

Statistical Arbitrage involves using statistical models and algorithms to find mispricings in financial instruments. By analyzing large sets of data, traders can identify patterns suggesting an asset is mispriced, allowing them to profit from the discrepancy.

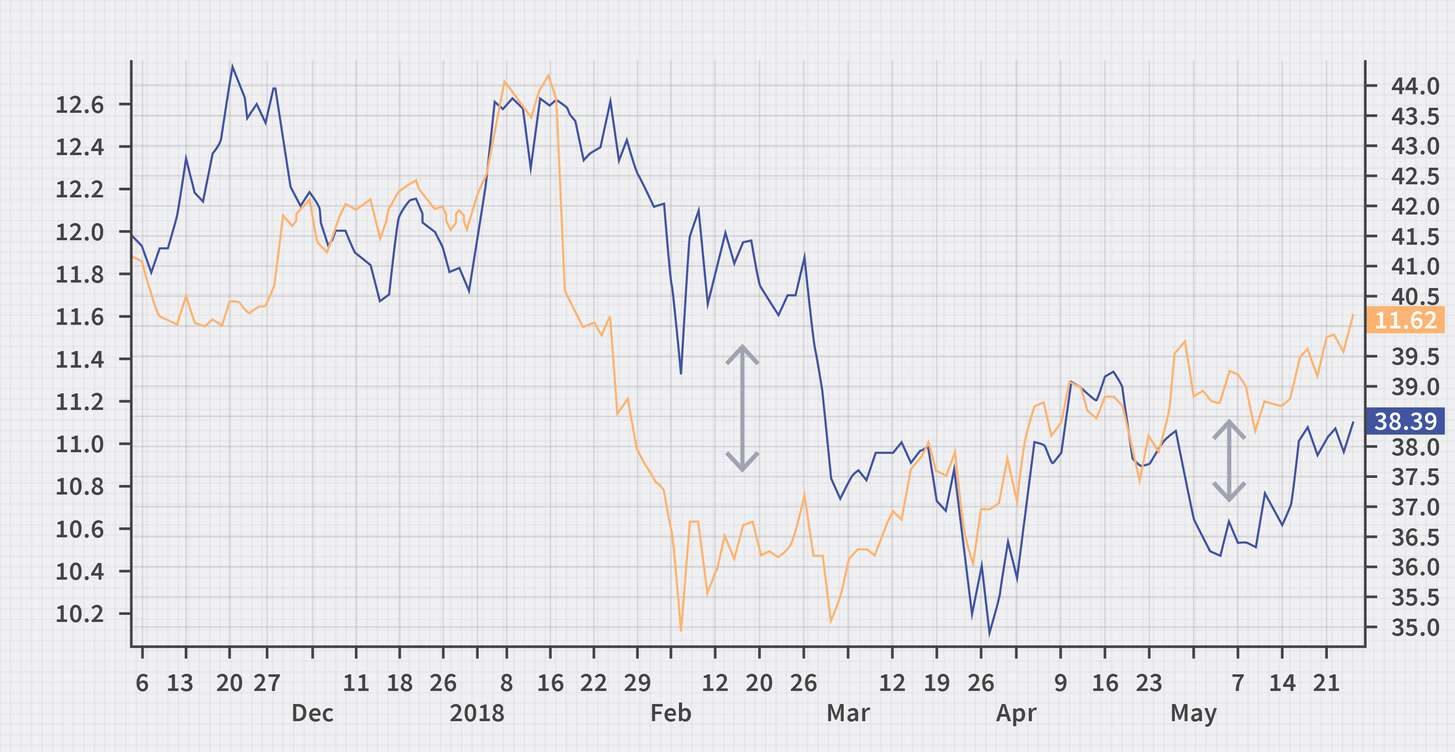

Pairs Trading is a type of statistical arbitrage where traders focus on two related assets in different markets. They look for situations where the relative value of the two assets deviates from their historical relationship. Traders then buy the undervalued asset and sell the overvalued one, aiming to profit from the assets converging back to their historical relationship.

Triangular Arbitrage exploits discrepancies in the cross-rates of three different currencies. For example, if the exchange rate between the US Dollar and the British Pound is higher than the rate between the US Dollar and the Euro, and the rate between the British Pound and the Euro is higher than the rate between the US Dollar and the British Pound, there’s an arbitrage opportunity. Traders can make a series of currency exchanges to capture a profit from the differences in exchange rates.

While arbitrage trading can be highly profitable but it comes with risks. Market changes can eliminate price discrepancies, and delays in executing trades may result in losses. Traders also face challenges like the need for access to multiple markets, the transient nature of arbitrage opportunities, and the necessity for quick actions.

Despite these challenges, successful traders can profit by carefully analyzing market conditions, identifying mispricings, and capitalizing on the opportunities. It’s crucial for traders to understand and manage the risks associated with arbitrage trading for consistent success.

References